PRIVACY POLICY FACTS WHAT DOES GE MONEY BANK DO ...

PRIVACY POLICY FACTS WHAT DOES GE MONEY BANK DO ...

PRIVACY POLICY FACTS WHAT DOES GE MONEY BANK DO ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

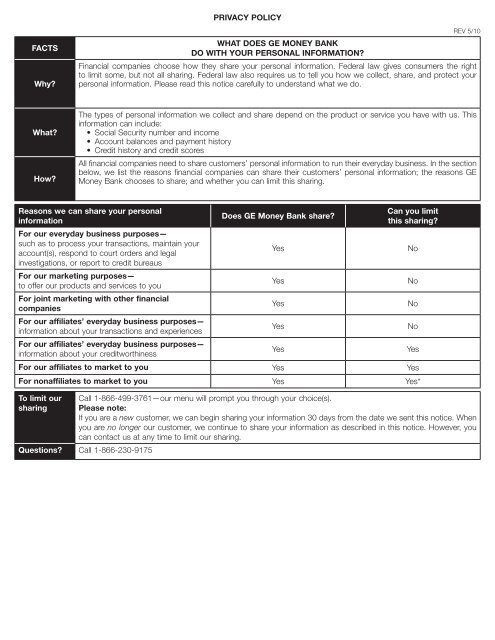

<strong>PRIVACY</strong> <strong>POLICY</strong><strong>FACTS</strong>Why?<strong>WHAT</strong> <strong><strong>DO</strong>ES</strong> <strong>GE</strong> <strong>MONEY</strong> <strong>BANK</strong><strong>DO</strong> WITH YOUR PERSONAL INFORMATION?REV 5/10Financial companies choose how they share your personal information. Federal law gives consumers the rightto limit some, but not all sharing. Federal law also requires us to tell you how we collect, share, and protect yourpersonal information. Please read this notice carefully to understand what we do.What?How?The types of personal information we collect and share depend on the product or service you have with us. Thisinformation can include:• Social Security number and income• Account balances and payment history• Credit history and credit scoresAll financial companies need to share customers’ personal information to run their everyday business. In the sectionbelow, we list the reasons financial companies can share their customers’ personal information; the reasons <strong>GE</strong>Money Bank chooses to share; and whether you can limit this sharing.Reasons we can share your personalinformationFor our everyday business purposes—such as to process your transactions, maintain youraccount(s), respond to court orders and legalinvestigations, or report to credit bureausFor our marketing purposes—to offer our products and services to youFor joint marketing with other financialcompaniesFor our affiliates’ everyday business purposes—information about your transactions and experiencesFor our affiliates’ everyday business purposes—information about your creditworthinessDoes <strong>GE</strong> Money Bank share?YesYesYesCan you limitthis sharing?For our affiliates to market to you Yes YesFor nonaffiliates to market to you Yes Yes*To limit oursharingYesYesCall 1-866-499-3761—our menu will prompt you through your choice(s).Please note:If you are a new customer, we can begin sharing your information 30 days from the date we sent this notice. Whenyou are no longer our customer, we continue to share your information as described in this notice. However, youcan contact us at any time to limit our sharing.Questions? Call 1-866-230-9175NoNoNoNoYes

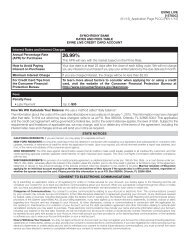

Page 2How does <strong>GE</strong> MoneyBank protect mypersonal information?How does <strong>GE</strong> MoneyBank collect mypersonal information?Why can’t I limitall sharing?What happens whenI limit sharing for anaccount I hold jointlywith someone else?AffiliatesNonaffiliatesWhat we doTo protect your personal information from unauthorized access and use, we use security measures thatcomply with federal law. These measures include computer safeguards and secured files and buildings.We collect your personal information, for example, when you:• open an account or give us your contact information• provide account information or pay your bills• use your credit cardWe also collect your personal information from others, such as credit bureaus, affiliates, or othercompanies.Federal law gives you the right to limit only:• sharing for affiliates’ everyday business purposes-(information about your creditworthiness)• affiliates from using your information to market to you• sharing for nonaffiliates to market to youState laws and individual companies may give you additional rights to limit sharing.See below for more on your rights under state law.Your choices will apply to everyone on your account.DefinitionsCompanies related by common ownership or control. They can be financial and nonfinancial companies.• Our affiliates include companies with a <strong>GE</strong>, General Electric or Monogram name; financial companiessuch as General Electric Capital Corporation and Monogram Credit Services; and nonfinancialcompanies, such as General Electric Company.Companies not related by common ownership or control. They can be financial and nonfinancial companies.• Nonaffiliates we share with can include the retailer named on your account and direct marketingcompanies.Joint marketingA formal agreement between nonaffiliated financial companies that together market financial products orservices to you.• Our joint marketing partners include insurance companies.Other important informationWe follow state law if state law provides you with additional privacy protections. For instance, if (and while) your billing address is inVermont, we will treat your account as if you had exercised the opt-out choice described above and you do not need to contact usto opt out. If you move from Vermont and you wish to restrict us from sharing information about you as provided in this notice, youmust then contact us to exercise your opt-out choice.*Please keep in mind that, as permitted by federal law, we share information about you with Kirkland’s, Inc. in connection withmaintaining and servicing the Kirkland’s Credit Card program, including for Kirkland’s, Inc. to market you. If you opt out of sharing withnonaffiliates, your opt out will not prohibit us from sharing your information with Kirkland’s, Inc.The above notice applies only to consumer Kirkland’s Accounts with <strong>GE</strong> Money Bank and does not apply to any other accounts youhave with us. It replaces our previous privacy notice disclosures to you. We can change our privacy policy at any time and will let youknow if we do if/as required by applicable law.For helpful information about identity theft, visit the Federal Trade Commission’s (FTC) consumer website at http://www.ftc.gov/idtheft.